"crazedclay: SBC murderer" (crazedclay)

"crazedclay: SBC murderer" (crazedclay)

03/21/2014 at 09:48 • Filed to: Offtopiclopnik

0

0

17

17

"crazedclay: SBC murderer" (crazedclay)

"crazedclay: SBC murderer" (crazedclay)

03/21/2014 at 09:48 • Filed to: Offtopiclopnik |  0 0

|  17 17 |

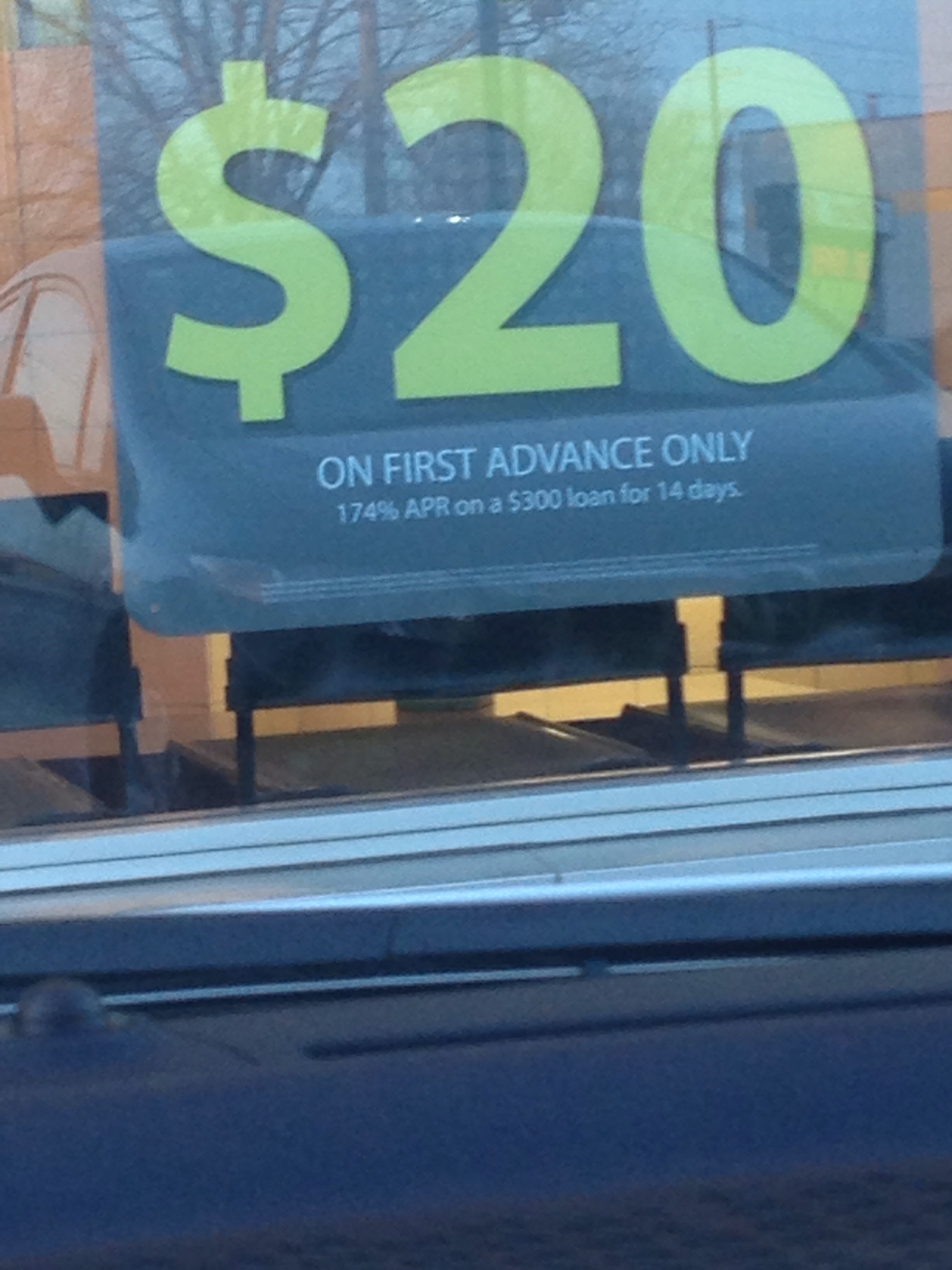

And saw the fine print .

174% for a payday loan

Toooootally acceptable, yup. I am uncertain of the legality of this shit.

EL_ULY

> crazedclay: SBC murderer

EL_ULY

> crazedclay: SBC murderer

03/21/2014 at 09:54 |

|

LOL. These are everywhere around my hood. Yay poor people :]

" I needed gas, I was bout to run out "

lol!!!!

RamblinRover Luxury-Yacht

> crazedclay: SBC murderer

RamblinRover Luxury-Yacht

> crazedclay: SBC murderer

03/21/2014 at 09:56 |

|

That's less than 7% of the amount if paid back in those 14 days. GREAT DEAL except perhaps not

Party-vi

> crazedclay: SBC murderer

Party-vi

> crazedclay: SBC murderer

03/21/2014 at 09:57 |

|

What is that, $21 after 14 days?

RamblinRover Luxury-Yacht

> Party-vi

RamblinRover Luxury-Yacht

> Party-vi

03/21/2014 at 10:01 |

|

$20, but on first advance only. Which means, the next time you go in, the APR is *over* 174%. The mind reels.

vdub_nut: scooter snob

> EL_ULY

vdub_nut: scooter snob

> EL_ULY

03/21/2014 at 10:04 |

|

VERTICAL FILMING

TEN FEET AWAY

STUPID PEOPLE ON TV

LITTLE BRATS YELLING AT THEIR DAD

DAD NOT EVEN RESPONDING

MORE LIL BRATZ

nope.

Jayhawk Jake

> EL_ULY

Jayhawk Jake

> EL_ULY

03/21/2014 at 10:05 |

|

They took a title loan on their car...to get gas for the car?!

Someone messed up somewhere in their life

EL_ULY

> vdub_nut: scooter snob

EL_ULY

> vdub_nut: scooter snob

03/21/2014 at 10:08 |

|

yup :]

EL_ULY

> Jayhawk Jake

EL_ULY

> Jayhawk Jake

03/21/2014 at 10:08 |

|

davedave1111

> crazedclay: SBC murderer

davedave1111

> crazedclay: SBC murderer

03/21/2014 at 10:09 |

|

Giving APR on payday loans is mandatory but completely misleading, because only the completely desperate or totally dumb take payday loans for months-to-years, and even if they do, the long-term APR is much lower. The interest over 14 days really isn't much, but the admin cost is high relative to the size of the interest payment for obvious reasons: it costs about the same in admin to loan someone $300 for 14 days as to loan someone $300k for 14 years, but obviously the ratio of admin costs to interest paid will be drastically different.

What the APR actually works out to here is a $20 total fee for the loan over 14 days, as made clear by the big '$20' in the ad. Multiply that up to an APR and you get 174%, but of course the arrangement fee isn't charged every two weeks if you take the money for longer.

In general, payday lending's actually a highly competitive market. Most payday lenders don't make a profit and go bust fairly fast. That indicates that in general that type of lending is priced at roughly what it costs to provide, and it's simply expensive to borrow money if you're poor. The costs would come down if we had much harsher - for example, criminal - penalties for people who didn't repay loans, although that has its own (social) cost, but as it is the honest-but-poor borrowers end up paying for their fellow borrowers who don't repay the loans or have to be chased hard for the money.

davedave1111

> Party-vi

davedave1111

> Party-vi

03/21/2014 at 10:11 |

|

$20, hence the huge '$20' in the ad.

davedave1111

> RamblinRover Luxury-Yacht

davedave1111

> RamblinRover Luxury-Yacht

03/21/2014 at 10:12 |

|

Is $20 an unreasonable fee? It's the use of APR which makes no sense here, because it's not a loan with a period of a year or more.

jariten1781

> crazedclay: SBC murderer

jariten1781

> crazedclay: SBC murderer

03/21/2014 at 10:12 |

|

Those short term loan places are the dregs. I know a guy who gets paid bi-weekly on Thursdays. His routine consists of going on Thursday to pay off his short term loan, then going out and spending every cent of his paycheck on Friday and Saturday. Then rolls around his non-pay week and he goes and gets another short term loan so he can go out that weekend. He's been doing it for years...who knows how much money he's wasted.

RamblinRover Luxury-Yacht

> davedave1111

RamblinRover Luxury-Yacht

> davedave1111

03/21/2014 at 10:16 |

|

I know. Very much an apples-to-oranges comparison, and a $20 fee *is* reasonable in that case objectively. One just considers that bumping the fee up to, say $30 on repeat visits, while still reasonable in a sense for an "I need cash now" contingency, viewed from the perspective of APR it would *sound* even more absurd.

Party-vi

> davedave1111

Party-vi

> davedave1111

03/21/2014 at 10:17 |

|

Sorry, I'm not used to seeing these.

Party-vi

> davedave1111

Party-vi

> davedave1111

03/21/2014 at 10:18 |

|

The use of "APR" makes sense, since (as you pointed me towards) $20 is 174% APR on $300 for 14 days.

davedave1111

> Party-vi

davedave1111

> Party-vi

03/21/2014 at 10:21 |

|

Nor am I. I didn't realise until after I worked it out - before that I thought they were advertising some kind of rebate/cashback.

Party-vi

> davedave1111

Party-vi

> davedave1111

03/21/2014 at 10:23 |

|

Same here. I was off by a bit in my math from using 0.5 months instead of 14 days for the term of the loan.